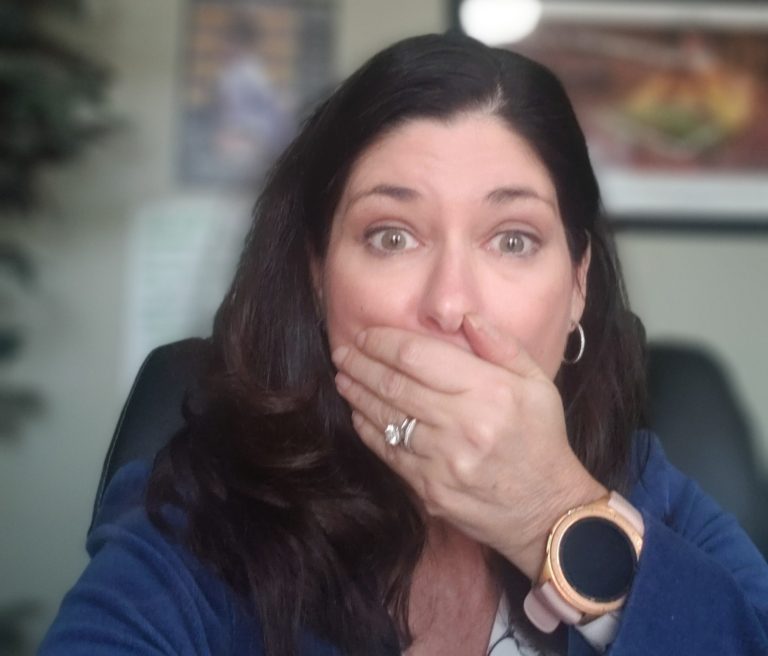

You have heard of the Envelope Budget, the Pay Yourself First Budget. But have you heard of the Oh $hit! Budget?

I was talking to a friend today about her job. The company that she works for is not doing well. Every quarter the CFO shows up from the corporate office and whacks however many people needed to make the budget.

As you can imagine, it doesn’t make her feel good.

I had a similar situation. A layoff seemed very plausible. I mean – how am I to know if I am next?

At the time I was single and balancing my first mortgage, trying to pay off my car, and not use my credit cards. I had a plan.

Suddenly, I started thinking a needed a plan B. I had lived through the great layoffs after 9-11 when everyone I knew in IT got laid off. Then I was a renter, and me sweet granny sent me a random $123 check each month.

Granny was gone. EEEK!

That’s when I developed the Oh $hit! Budget.

The Oh $hit! Budget is the one you dust off when you start to see bad things on the horizon. It is the one that gets you through the lean times until all is well.

It goes a little something like this:

1. Write down everything you pay for

2. Prioritize

3. Decide what you will eliminate or reduce

Ideally, you will see your Oh $hit moment coming and you will have time to get this budget out and start preparing. The goal is to boost your savings so you can weather the storm.

There are a couple of advantages to this.

1. If you have a good plan, you can potentially have less than 3 months savings in an emergency fund. That is going to depend on your plan, what type of job you have, and who is depending on you.

2. It makes it easy to implement because you are not figuring it out while stressed

3. You can pull it out if you want to save for a trip or another big purchase

For me, (this was before Netflix was digital #genx) it meant I went down to local channels only (oh the horror). I was a little warmer in the summer and a little colder in the winter. I pushed back haircuts, and didn’t get my nails done. I probably opted for slower internet too.

Remember, your Oh $hit! Budget is short term. You don’t have to live like this forever.

If you don’t have an Oh $hit Budget, or a budget at all, I am happy to walk you through the steps.

My favorite budget is the Crystal Ball Budget. Who doesn’t want one of those?